Prudent management of funds pays off

In the last year we have seen huge growth in the investment markets, with the FTSE 100 Index, which charts the 100 largest, most actively traded companies in the UK, reaching an all-time high at the time of writing.

But what do stocks and shares have to do with your independent funeral business?

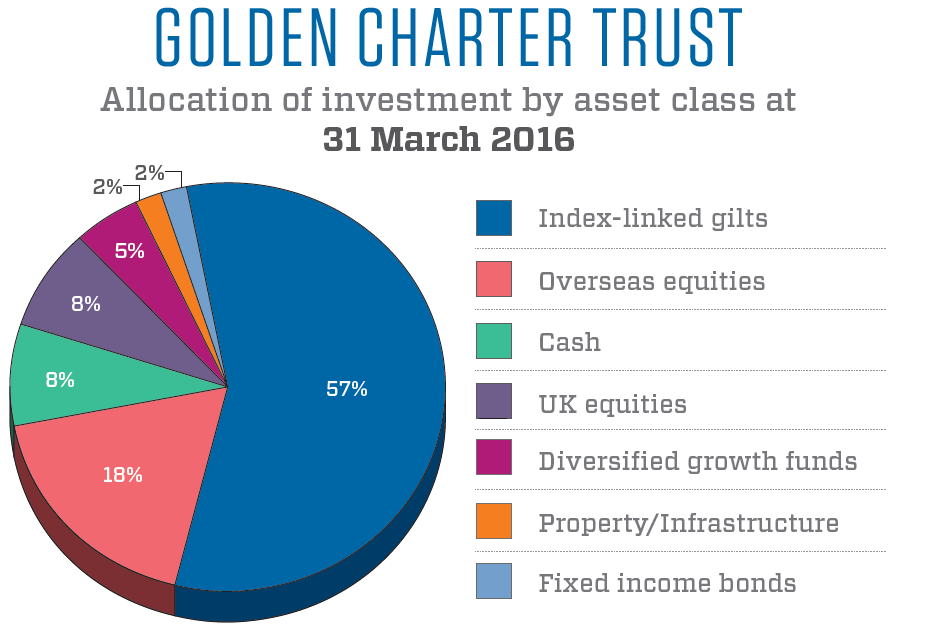

The truth is – a lot! The value of plan holder funds held in the Golden Charter Trust is directly connected with the investment markets. That’s because the money paid in is invested in a variety of different ways, known as diversification of assets, in order to limit the level of risk while seeking to ensure the money increases in value.

This shrewd management of funds combined with the strong health of the overall market have contributed to the Golden Charter Trust finding itself in its strongest position to date, with the ability at the moment to pay out more than 100% of the value of all the funeral plans held as plans mature.

The chart shown above tells us that most of the funds in the Trust are invested in index-linked gilts, diversified growth funds, UK and overseas equities, and property. In particular, the returns on index-linked gilts (bonds issued by the UK Government and usually considered low risk) have been unusually good, which is partly due to the introduction of new money into the economy by the Bank of England.

However, it is important we recognise that this remarkable level of growth, like all good things, must come to an end at some point. It is likely that future returns from gilts will return to traditionally lower levels, and the Trust does not foresee significant growth for businesses or the economy as a whole in the immediate future.

It is the aim of the Golden Charter Trust to continue to pay growth on funeral plans at a level at least equivalent to the Consumer Price Index (CPI), which is based on the cost of living in the UK. However, rising inflation and the fall of the pound against most foreign currencies are likely to lead to a rise in the cost of importing goods, which will impact the investment markets. As a result, the Trust needs to review its strategy for making investments in the future to reflect the current market conditions, to try to ensure this CPI level of growth can be maintained.

It is important for funeral directors to consider and understand the current outlook, and what choices are available. When any funeral plan is sold, the proceeds are held in the Golden Charter Trust. If the plan is an Independent Way plan, the funds are segregated in the Independent Way sub-fund of the Trust. Both segments of the Trust have the same aim but the life expectancy of the plan holders in each segment is different, as is the spread of expected maturity dates, and these differences must be taken into account when decisions on how best to invest the funds are made.

Historically, the funds in the Independent Way sub-fund have been invested in ways which are seen as lower risk. However, in recent years the conditions have allowed the Trust to deliver inflation-busting growth on these ‘safer’ investments. None of us can rely on this unexpected bonus continuing indefinitely, and need to invest the funds in the best way to make sure the purpose of the Trust is delivered: to continue to provide security to the independent funeral directors who will carry out the funerals.

Of course, the money you receive when carrying out a funeral plan does not rely completely on how the investments of the Trust have performed. The majority share of the Additional Maturity Bonus (AMB) is used to top up older, fully guaranteed plans, all of which come from the Golden Charter Trust, and the Trust and the company have agreed that this arrangement should continue while surpluses are available.

The Trustees do not expect to see investment returns change overnight, but it is important that funeral directors who are beneficiaries of the Trust understand that in 2014 the decision was made to moderate the annual growth rate of plans from the Independent Way sub-fund due to the modest outlook on investment returns. For Golden Charter set plans, there has been less pressure to reduce the growth rate, which has been increasing at a lower rate.

The Trustees always aim to work with the company to protect the long-term interests of plan holders, while delivering sustainable and affordable plan pay outs for independent funeral directors. If you would like more information on the Golden Charter Trust, please visit goldenchartertrust.co.uk.

Tags: finance, fund, Golden Charter, investment, Malcolm Flanders, Trust